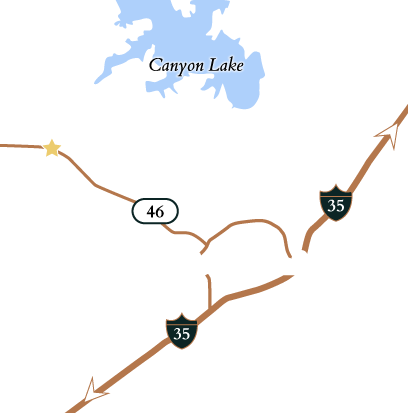

Texas’ Hill Country is the fourth-largest region in the Lone Star State, sprawling across 31,000 square miles, and situated on the Edwards Plateau and Balcones Escarpment. Bounded by Interstate 35 and U.S. 83 on the east and west, and bracketed by SH 29 and U.S. 90 on the north and south, respectively, the Hill Country is consistently lauded for its scenic vistas, award-winning festivals and wineries, and a plethora of shopping and outdoor activities.